Dear Clients & Friends:

2018 has been a year to forget, in many ways. And yet…

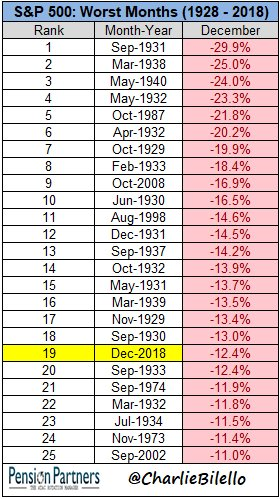

Unemployment is at a ~50-year low, the economy continues to chug along at about a 3% GDP annual growth rate, corporate profits are at a post-war record, and consumer spending (PCE) is up on both a month-over-month and year-over-year basis. Yet we just suffered the single worst week in the stock market since November of 2008, losing 7-8% in five trading days (depending on which benchmarks you use). And through today, this month is on pace to be the second worst December since 1931, and in the top 20 worst months of all time. All but three of the others occurred during the Great Depression.

What the heck is going on?

There are some reasons for the market volatility that make sense—uncertainty with regard to the US-China trade war; uncertainty about what caused the 40% drop in crude oil prices since October; uncertainty over the government shutdown; and maybe some confusion about the Fed’s message this week (despite the certainty that they did in fact hike the Fed Funds Rate another 0.25%).

Is it possible that one or more of these things throws our economy into recession? Yes, anything could happen. Is it likely? I don’t think so—in my opinion, there are too many things that can go right from here. And by “right,” I don’t necessarily mean that great news is around the corner; I just mean that we may have very swiftly gone from a relatively calm market to one that is discounting the worst case scenario for all the aforementioned events.

Who wins if there is no US-China trade deal? Not the American consumer, or company. And certainly not the Chinese. But there has been progress announced to this end multiple times—by both US and Chinese authorities—since the G-20 meeting in Buenos Aires last month.

Who wins if oil stays down below $50/barrel (after having been near $80 just three months ago)? The consumer of oil/gas/etc, sure, but the economic impact to the US economy of too-low oil was already seen in 2015, and it was a very near disaster. Saudi Arabia just released their fiscal budget for 2019 and it assumes ~$85 oil—in spite of anything you’ve read to the contrary, the Saudis very much still set the price for oil. And they don’t just want it higher, they need it higher.

A government shutdown? We’ve been here before, what feels like a dozen times since the GFC. Any shutdown is unlikely to last long or have any material impact on our economy or markets.

What did the Fed actually say this week that spooked markets? First of all, Jay Powell was put into a nearly impossible position by our President. Was it reasonable to expect Chairman Jay Powell to handle an impossible situation perfectly? President Trump all but dared him to raise rates—letting the world know his feelings in advance of the Fed decision, that the Fed had already raised rates too far. Now, the Fed is a notoriously apolitical institution, and I don’t believe this has anything to do with why Powell and the Fed stuck to their guns and raised rates this week. They did so, as he clearly outlined in his statement, because the economy is strong. The economy is strong.

The Fed did, however, bring down their estimates for 2019 rate hikes (from three to two), and made it very clear—with even more clarification from Fed member John Williams today—that they were not ignorant of stock market volatility, and that they would continue to watch developments whilst maintaining flexibility with their plans for next year. Their goal, Williams stated unequivocally, is to keep the economy on its path of growth and to maintain maximum employment.

So, if all of that is true, why does it feel like the market doesn’t believe it? Well, there is an old saying that “Nothing changes sentiment like price,” which means that with high prices comes excitement and enthusiasm. With low prices comes fear, anxiety, even panic.

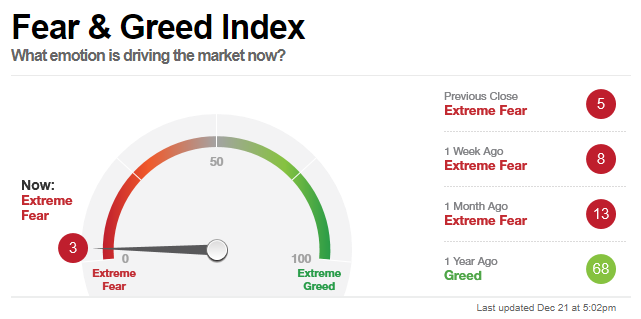

I’ve referenced the CNN Fear & Greed Index many times, and weekly readings below 20 are rare. Below 10 are almost always a buy signal. Below 5 is something I can’t recall seeing before. Below is today’s reading….

This came with a VIX spike above 30. As a reminder, the VIX can be most easily explained as a “fear gauge” for the market—essentially, VIX measures how much people are willing to pay for protection from a further market fall.

All four of the circled areas before today’s marked notable lows for the stock market.

There are already headlines crossing that the government may have a deal to avert a shutdown, though I personally think that is the least concerning all of the concerns outlined above. But it is one.

Will we get a US-China deal over the weekend? Unlikely. But there is certainly room for improvement in the dialogue. Both sides want a deal, and both sides are likely to make some concessions. They may not advertise it that way to their respective constituencies, but it’s the most likely outcome in my opinion.

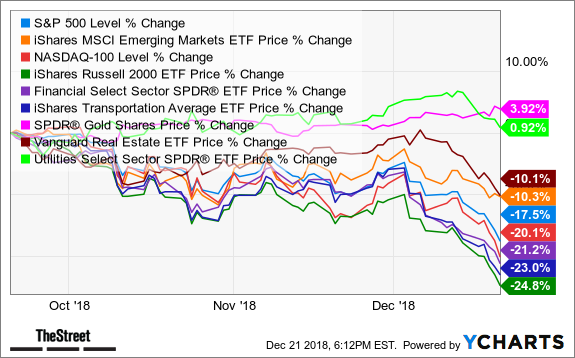

If you’re wondering if there was a better place to have had your money over the last three months, the answer is “yes.” Utilities, cash, and gold are about it….

Other asset classes that have held up relatively well are REITs and, believe it or not, Emerging Markets—though both are down over 10% so far in Q4. Seeing everything move down together may not be much solace, but it should be…. One similarity shared by durable market bottoms is a high correlation of all asset classes to the downside.

While no one can say when the most optimal time to be buying stocks will be, history says we are very close (if not there already). One thing I can confidently say is that this is not a good time to be selling.

We will be available all next week. Please call or email if you want to discuss your portfolio or have any questions at all.

All my best,

Adam