Dear Clients & Friends:

There aren’t really any words to accurately describe the week we all just experienced. In the news, in our local schools and stores, in our own homes, and of course in financial markets. It has been unprecedented in every way.

There are lots of opinions floating around about what’s happening—why the market seems to be falling apart; how serious Covid-19 (Coronavirus) is; how long the state-specific but quasi-mandatory shutdowns will last; what the economic damage will be; how much of said damage will be offset by Government stimulus; ad infinitum. The one thing that everyone seems to agree on, however, is that things are bad. Immeasurably bad.

And, we use the word ‘immeasurably’ in the literal sense—we cannot actually measure how bad things supposedly are. Or might become. Because we don’t know….

We are seeing estimates for Q1 and Q2 GDP to not only come in negative, but a -20% number for Q2 was thrown out by a major bank this week. That’s certainly not consensus, but a sub-zero reading seems all but a foregone conclusion at this point. The argument being—if people can’t leave their homes, how can they be spending? But what about the fear that shopping malls and businesses that require physical locations are doomed because of the rise of online shopping?

Reminder: More than 70% of US GDP comes from consumption.

Estimates for upcoming unemployment readings are equally ominous, with anyone in food, travel, or hospitality being the first and hardest hit. We’ve seen many employers, wherever possible, institute “work from home” (WFH) orders. There are significantly fewer cars on the road, that’s for sure. But how many full-time jobs have actually been lost, permanently? Are employers and employees taking advantage of Coronavirus-related leniency with the Unemployment Office to ensure there is no gap in their take-home pay? We just don’t know.

Prior to the Coronavirus outbreak, our nation’s unemployment was at a ~50-year low, with the economy chugging along at about a 2% annual GDP growth rate, down from the 2.2% rate of 2019. The stock market was up over 25% last year.

But as of now, this month is on pace to be the single worst since October of 2008, during the depths of the Global Financial Crisis (GFC). And this is the fastest drop from an all-time high into a bear market (more than 20%) on record. It’s been breathtaking and heartbreaking.

Making it worse is just how unknown all the unknowns are. Nobody can tell us with any degree of confidence how long this will last, or the extent of the economic damage when it’s all said and done. Could it be less than what the most negative projections suggest? A lot less? Is it possible that, after a successful nationwide quarantine period (perhaps assisted by warming weather), the economy more or less gets back to functioning as it should? Maybe not all at once but in a reasonable amount of time? We just don’t know.

I like to focus on the things we do know.

There is an old saying that “Nothing changes sentiment like price,” which means that with high prices comes excitement and enthusiasm. With low prices comes fear, anxiety, even panic.

Is it possible that the plunging stock market has exacerbated fears about the damage that may, or may not, be inflicted on the U.S. economy? It didn’t feel like economic damage related to the virus was on too many minds until the stock market began dropping.

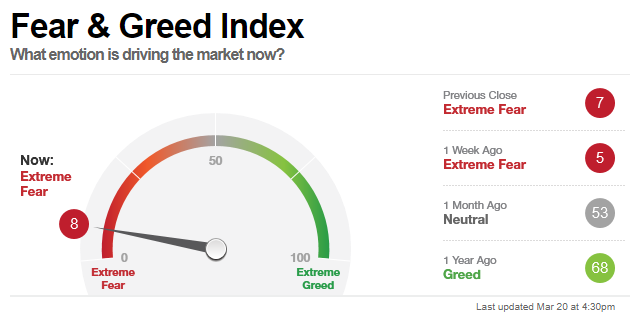

I’ve referenced the CNN Fear & Greed Index many times, and weekly readings below 20 are rare. Below 10 are a contrarian buy signal, almost without fail. Below is today’s reading….

That is up from a reading of 3 earlier this week, and came with a VIX spike above 80.

As a reminder, the VIX can be most easily explained as a “fear gauge” for the market—essentially, VIX measures how much people are willing to pay for protection from a further market fall. We haven’t seen a VIX this high since 2008. Here is a chart showing abnormally high VIX readings/spikes over the last five years.

All three of the circled areas before today’s marked notable lows for the stock market.

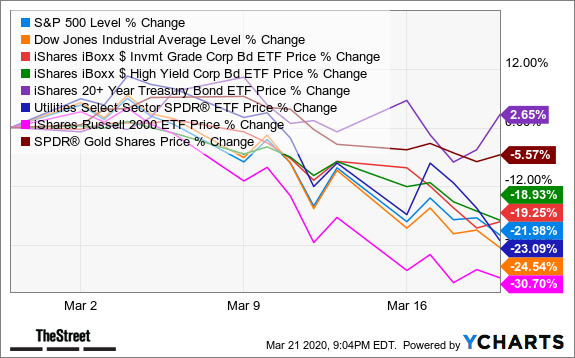

If you’re wondering if there was a better place to have had your money over the last three weeks, the answer is “not really.” Treasury Bonds and cash are the only things that haven’t lost money since March 1st. Even gold is off 5%. High quality (Investment Grade) Corporate Bonds and Utilities, typically a safe haven, are down -19% and -23%, respectively….

Seeing everything move down together may not be much solace, but it should be…. One common quality of durable, long term market bottoms is a high correlation of all asset classes to the downside. It is a sign that investors are throwing in the towel across the board and an indication that sellers may be reaching exhaustion. They are no longer selling what they want to, they are selling everything… (this is good!)

While no one can say when the most optimal time to be buying stocks will be, history says this is not a good time to be selling. Will we find a medical solution to Coronavirus that gets the economy back on track in short order? That seems unlikely, though not entirely impossible. Will there be a solution of some kind, enabling US companies and workers to find a way through this, amidst a backdrop of 0% interest rates and record Government spending/stimulus the world over? I think it’s foolish to dismiss that possibility…

There are many resources, but here is one place (click here) to keep up with the latest stimulus packages being discussed around the world. The most recent number in the U.S. alone is a staggering $4 trillion, and includes new authority for the Federal Reserve to buy US Corporate Bonds. This should help alleviate stress in credit markets almost immediately.

It’s hard to remain calm when the sky is falling. It’s hard to think about a strategy going forward when every instinct says we should be hiding under our desks just like children did during the nuclear war drills in school during the 1950s. That probably wasn’t going to help much if someone had dropped a nuclear bomb on us, but, nevertheless, children practiced hiding.

Most of us will not be infected by the Coronavirus, but we will all be affected.

I understand why the airline companies, and the cruise and hotel industries have taken a big hit. We aren’t traveling right now. Nobody with access to current events would take an all-expenses paid cruise right now. These industries will need (and will likely get) federal assistance.

But why have high quality utility companies—like Dominion, Southern Company, and Duke Energy—seen their stocks lose 30-40% of their value? Are people suddenly going to stop using electricity and gas? Is Waste Management (WM), a $50 billion waste management and recycling behemoth, really worth 30% less than it was a month ago?

It is time to think about long term strategy. It is time to consider that “one man’s trash may be another man’s treasure.” This is not about being a hero, taking a huge swing at what looks like it could be a generational opportunity—there is still just way too much volatility, and the predictability in the very short term is close to zero.

But it is time to put some cash to work in high quality companies that have been sold indiscriminately. It is time to look out 3-, 6-, 12- months – past the Coronavirus – and ask yourself what companies you’d like to have bought at 30-40% discounts. It is time to keep our heads, because others are most certainly losing theirs.

Though I might like to forget it, I remember the 2008-2009 period very well. We have seen markets do this before. It doesn’t make it easier, or any more fun. But we have seen it before. The storm will pass, normalcy will return, and you will be rewarded for having not overreacted to the fear which is so palpable today.

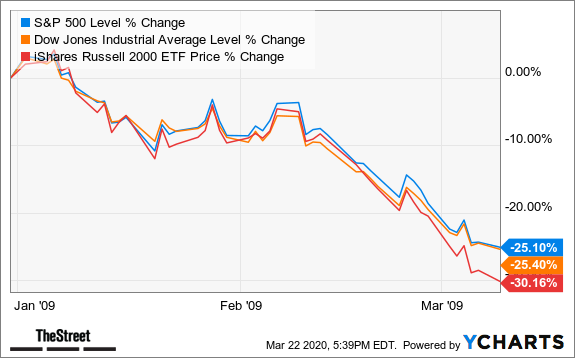

Below is a chart of the S&P 500, Dow Jones Industrial Average, and Russell 2000 (Small Cap Index) from January 1st – March 9th 2009 (which ended up being the bottom).

The S&P, Dow, and Russell finished 2009 up 23%, 19%, and 26%, respectively. This is not a prediction for what happens in 2020, but a reminder that it is always darkest before the dawn.

We will be available all next week. Please call or email if you want to discuss your portfolio or have any questions at all.