On March 27, 2020 the U.S. House of Representatives sent a $2.2 trillion emergency fiscal stimulus package, called the Coronavirus Aid, Relief and Economic Security Act to the White House for the president’s signature. The CARES Act, representing approximately 10% of the annual gross domestic product (GDP) of the United States, was designed to blunt the negative economic impacts of COVID-19 on the U.S. economy.

The CARES Act was designed by the Senate and House to provide tax credits, loans and direct payments to individuals, businesses, state and local governments, and health care providers to help meet their cash-flow needs over the next several months.

The CARES Act (HR 748 – viewable in its entirety here: https://upload.wikimedia.org/wikipedia/commons/1/1d/CARES_Act_Enrolled_Bill.pdf

We discuss below the provisions of the Act that are likely to be of interest to you – our valued clients – as spouses, parents, caregivers, retirees, employees, executives and business owners.

1) Direct Payments to Individuals

Also known as “recovery rebates,” the CARES Act provides for direct payments of $1,200 to individuals that had an adjusted gross income (AGI) of $75,000 or less in 2019 (or 2018 if taxes for 2019 have not yet been filed). For every $1,000 of AGI above $75,000, direct payments shall decrease by $50 up to an AGI of $99,000, where the payments will be phased out completely.

Similarly, a married couple filing jointly is slated to receive $2,400 – up to a household AGI of $150,000. This payment will be reduced as a couple’s adjusted gross income exceeds $150,000 – and will be phased out completely for a household AGI above $198,000. For an individual filing as the head of household (many of whom are single parents), direct payments of $1,200 will be sent to those with AGI’s up to $112,500 and reduced above this level. In addition to these provisions, households may also receive $500 for each qualifying child (16 and under). The Secretary of the Treasury has indicated that he expects these payments to be sent to individuals that qualify within three weeks of the CARE Act’s passage on March 27th (i.e., no later than April 17th).

2) No Required Minimum Distributions in 2020

The CARES Acts has granted an exemption such that required minimum distributions (RMDs) from qualified retirement accounts are no longer mandated for the current 2020 tax / calendar year.

3) Early Withdrawals from Retirement Accounts

The CARES Act stipulates that “impacted” individuals under 59 ½ may withdraw up to $100,000 from their IRA’s without a 10% penalty through the end of 2020. Individuals may also opt to pay the taxes on these distributions over a three-year period, as opposed to paying all income taxes in the current tax year. In addition, the standard 20% federal withholding will not be required for these distributions during the 2020 calendar year. Finally, distributions from qualified retirement plans may be repaid, if desired, over 3 years following a distribution.

Note: an “impacted” individual is anyone who has experienced adverse financial consequences because of COVID-19, has a spouse or dependent that has tested positive for COVID-19 or has tested positive for COVID-19 themselves.

4) Loans Against Retirement Plans

In addition to the above retirement plan provisions, “impacted” individuals are allowed to take up to $100,000 in loans (up from $50,000) from a qualified retirement plan (401(k), 403(b) and 457(b)) – during the 180 days from the date the CARES Act was enacted (March 27, 2020 through the end of September, 2020). A related provision allows for loans of up to 100% of the vested value of an individual’s account balance (formerly 50%), up to $100,000.

5) Unemployment Benefits

The CARES act provides for an increase of $600 / week for up to four months of unemployment. The ACT also provides for the expansion of unemployment benefits for those who would otherwise not normally qualify (e.g., independent contractors, self-employed individuals and independent contractors).

6) Student loans

Federal student loan borrowers are not required to make any payments through September 30, 2020. During this period, no interest will accumulate on those federal loans. Additionally, employers can provide up to $5,250 in tax-free student loan repayment benefits for their employees. That means an employer could contribute to loan payments and workers wouldn’t have to include that money as income.

7) Payroll Protection Loans

The CARES Act also provides for Payroll Protection loans of up to $10 million to COVID-19 impacted businesses. The loans 1) are guaranteed 100% by the Small Business Administration (no personal guarantees or collateral required); 2) must be taken out between February 15, 2020, and June 30, 2020; 3) may be forgiven for amounts used to cover basic operating expenses such as payroll costs, rent and mortgage, and utilities for up to two months from the loan origination date (excluded from COD income); and 4) have a maximum maturity rate of 10 years and 4% interest if not forgiven. To read more about these SBA loans, click here: https://www.sba.gov/funding-programs/disaster-assistance

8) Additional Provisions Affecting Businesses

- Payroll Tax Credits to Businesses Affected by the COVID-19 Outbreak. The law provides for a 50% payroll tax credit to reimburse wages paid up to $10,000 per employee. The credit is available to employers that faced significant disruptions to their operations and revenue streams as a result of the COVID-19 outbreak.

- Expanded Net Operating Loss Carrybacks. Businesses can carry back losses incurred in 2018, 2019, and 2020 to the five prior tax periods. These losses can fully offset the taxable income in the year to which the losses are carried back because the law temporarily suspends the rule limiting loss deductions to 80% of income. These favorable loss carryback rules can reduce a business’ tax liability in 2020 by generating additional refunds and credits for overpayments of taxes.

- Suspension of Excess Business Loss Limitations. The Tax Cuts and Jobs Act limited business owners from deducting business losses of more than $250,000 ($500,000 for married taxpayers filing jointly) as adjusted for inflation. The CARES Act suspends this limitation through the end of 2020, enabling some taxpayers to further reduce their tax liabilities for 2020 and prior taxable years in which this limitation applied.

- More Favorable Business Interest Expense Limitation in 2020. Interest expense incurred by businesses is normally not deductible to the extent such expenses exceed 30% of taxable income with certain modifications. The CARES Act increases the cap to 50% for the 2019 and 2020 taxable years, allowing businesses with high interest expense relative to income to take a higher interest deduction and reduce their tax liability. Notably, under the law, a business may calculate its 2020 business interest expense using its 2019 taxable income, potentially creating a larger deduction or loss that can be carried back.

- Delayed Payroll Tax Payments. Employers may delay the payment of 6.2% payroll taxes until January 1, 2021. Deferred payroll tax payments will be due in two equal installments payable on December 31st of 2021 and 2022.

- Certain Real Estate Improvements Now Eligible for 100% Depreciation. The law classifies qualified improvement property as 15-year property that is now eligible for 100% bonus depreciation. This provision will allow for significant offsets to taxable income for the 2019 and 2020 taxable years as well as for tax refunds for 2018.

9) Other Provisions of the CARES Act

- Any company receiving a government loan would be subject to a ban on stock buybacks through the term of the loan plus one additional year. The companies also would have to limit executive bonuses and take steps to protect workers. In addition, borrowers have to make a “good faith certification” that they will stay neutral in any union organizing effort over the term of the loan.

- For airlines, there will be $57 billion in grants and loans to help support the industry.

- Small businesses would receive more than $350 billion in aid, but they must agree to retain workers.

- The U.S. Federal Reserve will be empowered to pump $4 trillion in direct aid to local governments and industries. This should help to stabilize the municipal bond market.

- Scheduled cuts to Medicare and Medicaid will be rolled back, a step that would give providers billions more dollars in coming months and extend until November federal programs such as community health centers that are working on the front lines of the outbreak.

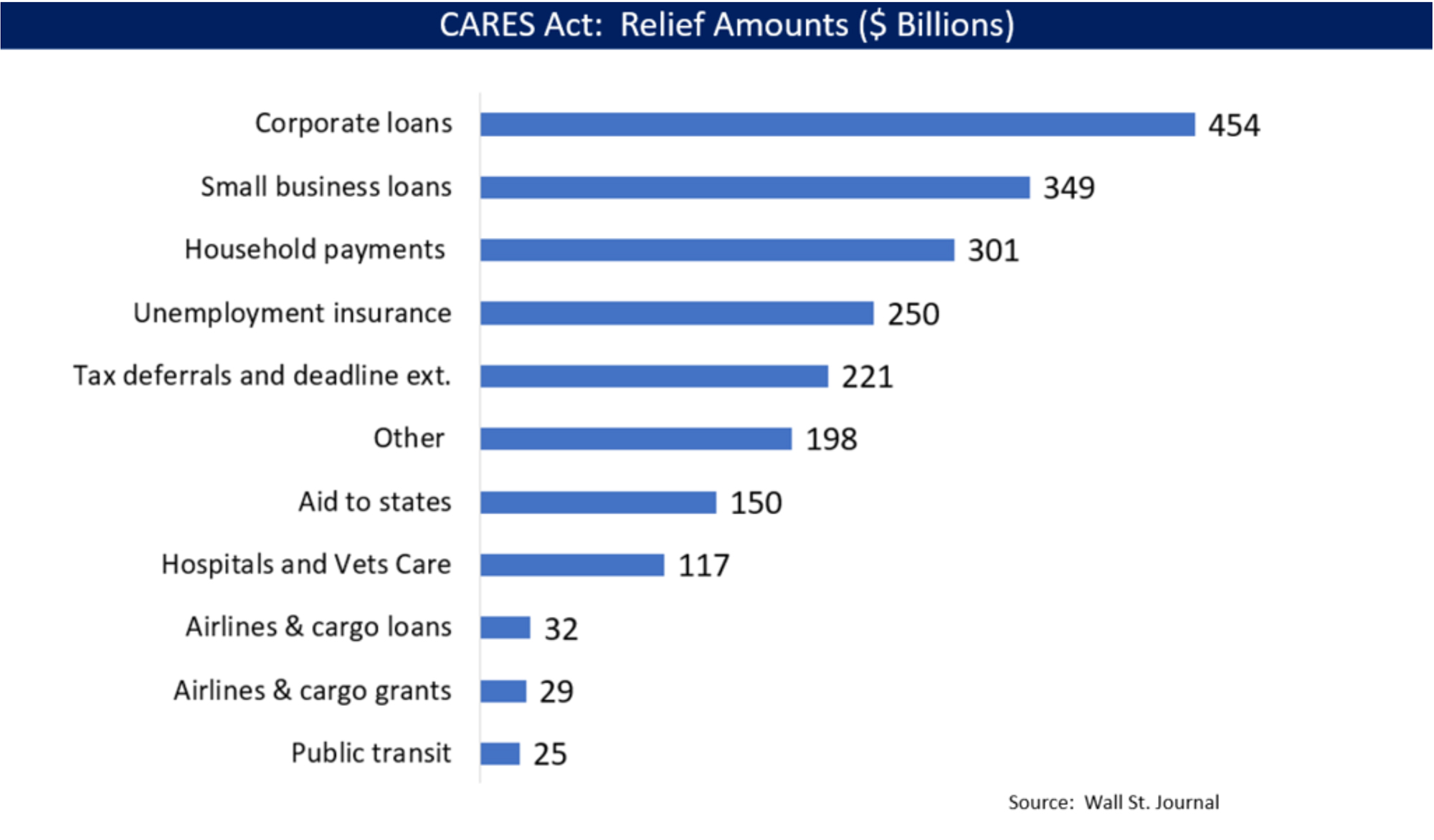

The approximate dollar amounts earmarked for various sectors of the U.S. economy can be seen in the chart below (from the Wall Street Journal):

Because many of the CARES Act’s relief programs will be shaped by administrative agencies, such as the SBA, which are tasked with implementing the legislation with rules, regulations, and procedures, it may take some time before all the specifics of the relief package become clear.

As always, please feel free to reach out with any questions.

Stay in touch and stay well!

Stephen MacIntosh, CWS®, CPFA

Director of Financial Planning

Investment Advisor